Getting Started

This document serves as a comprehensive guide to integrating the Khalti Payment Gateway (KPG) into your system. The integration process involves signing up as a merchant, understanding the integration methods for web and mobile, and transitioning to a live environment after successful testing.

1. Signup as a Merchant in Khalti¶

Before proceeding with the integration, it's essential to understand the terms used throughout the documentation:

- Merchant : Online business services such as e-commerce websites, ISP online payment portals, or online movie ticket platforms seeking to receive online payments via KPG.

If you're new to Khalti Payment Gateway service, familiarize yourself with its offerings by reading here for a better understanding.

To initiate the integration process, sign up as a merchant account :

2. ePayment Gateway Integration¶

The integration process varies depending on whether you're integrating KPG on a web or mobile platform. Follow the steps outlined below accordingly:

2.1. Web Checkout¶

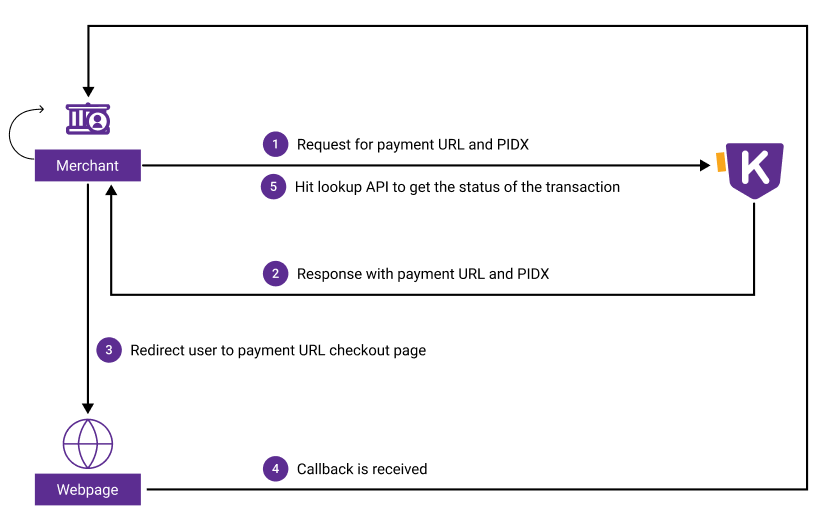

The payment process flow of KPG Web Checkout is as follows:

The payment process flow of KPG Web Checkout is as follows:

- Merchant requests Khalti to initiate the online payment.

- Khalti system returns with

pidxandpayment_url. - The user must be redirected to

payment_url. - After payment, callback is received from Khalti system.

- Merchant side must hit the lookup API to get the status of the transaction.

If you are looking to integrate KPG on web application, then the integration must be done by integrating the web checkout. Please follow the documentation here to proceed Web Checkout.

Checkout provides all the necessary Uls and perform necessary processes to initiate and confirm the payment.

2.2. Mobile Checkout¶

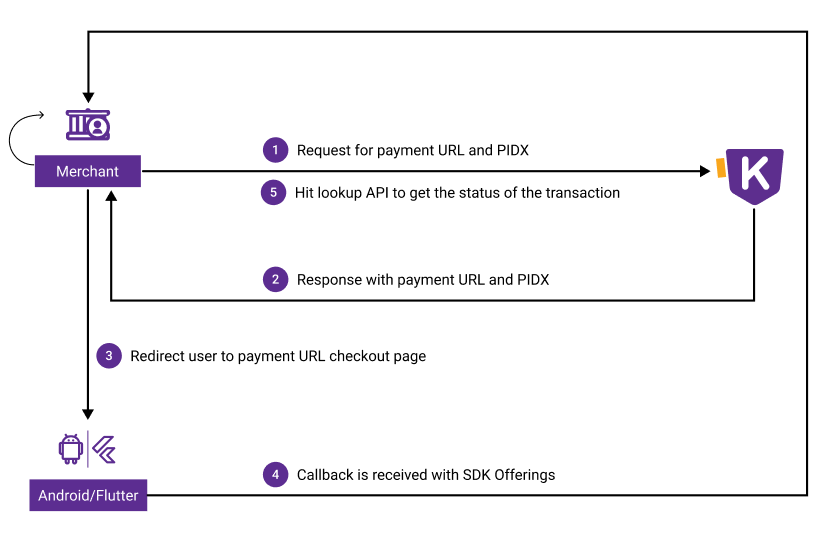

The payment process flow of KPG SDK (Android & Flutter) is as follows:

- Merchant requests Khalti to initiate the online payment.

- Khalti system returns with

pidxandpayment_url. - The merchant system must pass

pidx,keysandreturn URLin client side SDK (Android and Flutter) for initiating the online payment. -

After payment, the return message is obtained on the client side along with extra SDK offerings.

-

Merchant side must hit the lookup API to get the status of the transaction.

Note

The return url must be same while generating PIDX and in SDK To get callback or SDK offering

If you are looking to integrate KPG in mobile, then the integration must be done by integrating the provided SDKs. Please follow the documentation here to proceed:

Checkout provides all the necessary Uls and perform necessary processes to initiate and confirm the payment.

3. Test Environment¶

Access Information

For Sandbox Access

Signup from here as a merchant.

URL : https://dev.khalti.com/

Server Side Authorization Key : Live secret key

Client Side Authorization Key (Android / Flutter SDK): Live public key

Test Credentials for sandbox environment

Test Khalti ID for 9800000000 9800000001 9800000002 9800000003 9800000004 9800000005

Test MPIN 1111

Test OTP 987654

Important

Payment via E-Banking and Debit/Credit card is not supported in the test environment. However, after successful integration with KPG, this functionality will be enabled.

4. Going Live¶

After a successful integration test, a live merchant account must be created from here. The merchant must replace the Sandbox URL and authorization key with productions. Live keys will be generated in the merchant dashboard.

Access Information

For Production

Signup from here as a merchant.

URL : https://khalti.com/

Server Side Authorization Key : Live secret key

Client Side Authorization Key (Android / Flutter SDK): Live public key

Important

Even after successful integration, you won't be able to receive payments above NPR 200 per transaction. Fill the KYC form and contact us at 9801890085 / 9801856440 / 9801165558 / 9801165557 to remove the limits and accept payments without restrictions.